The deal that weds the hottest-selling drug Humira with the perennially popular beauty treatment Botox will cost $63 billion in stock and cash - specifically, AbbVie will be paying Allergan 6/7th of it's own share (worth $67.94) and $120.3 in cash for each share in Allergan. The purchase consideration of $188.24 per share therefore works out to a 45% premium to its last trading price. Allergan's CEO Brent Saunders will join AbbVie's board while AbbVie's CEO Richard Gonzalez will continue as the CEO of the combined company.

Pharmaceutical companies make money by investing in R&D to develop drugs that they can patent and sell at high prices. The problem is that patents aren't granted for an indefinite term - so companies continue to earn handsome profits through the life of the patent while developing other drugs that can be patented to generate revenue that takes its place. And the cycle continues. Once a patent runs out, generics flood the market and then, with increased competition, ensure that prices and sales for the drug drop significantly. In this scenario, life naturally becomes difficult when continued investments don't yield the required results and so, when new drugs don't make it to final approval or do so only after significant increase in investment, the resources to continue development also start drying up. According to Deloitte, project return on investment on R&D for the top 12 pharmaceutical companies have fallen to 1.9% in 2018, from 3.7% in 2017 and 8.2% in 2010. It is currently expected that the industry will not be able to recover from the onslaught of significantly higher development costs related to big and relatively inefficient structures of top companies, inordinately long time to develop a product and inadequate use of technological tools (robotics, AI, etc.) to date. While technology investments have stepped up of late, it typically takes a few years to feel the effect of these investments.

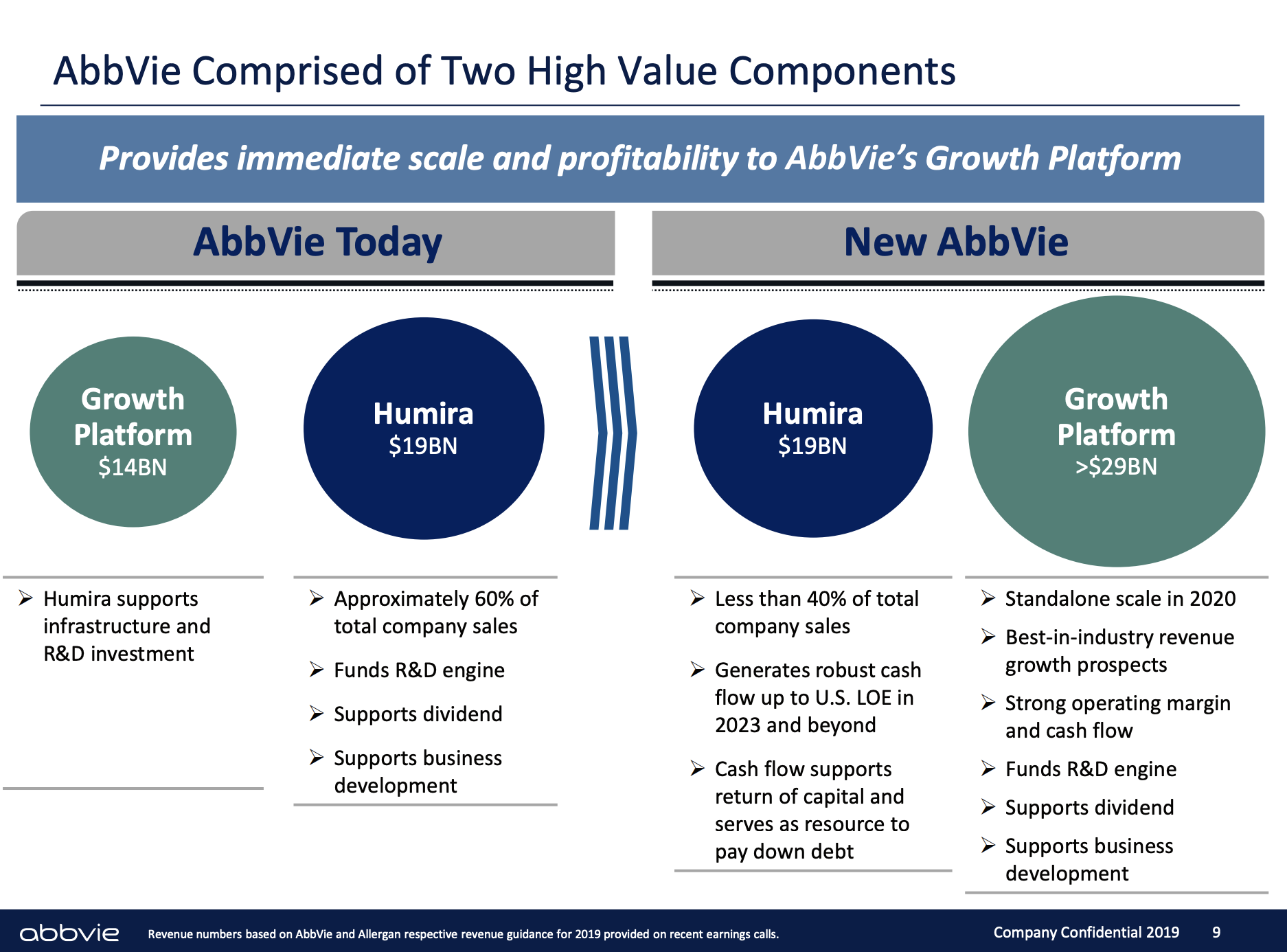

Pharmaceutical companies make money by investing in R&D to develop drugs that they can patent and sell at high prices. The problem is that patents aren't granted for an indefinite term - so companies continue to earn handsome profits through the life of the patent while developing other drugs that can be patented to generate revenue that takes its place. And the cycle continues. Once a patent runs out, generics flood the market and then, with increased competition, ensure that prices and sales for the drug drop significantly. In this scenario, life naturally becomes difficult when continued investments don't yield the required results and so, when new drugs don't make it to final approval or do so only after significant increase in investment, the resources to continue development also start drying up. According to Deloitte, project return on investment on R&D for the top 12 pharmaceutical companies have fallen to 1.9% in 2018, from 3.7% in 2017 and 8.2% in 2010. It is currently expected that the industry will not be able to recover from the onslaught of significantly higher development costs related to big and relatively inefficient structures of top companies, inordinately long time to develop a product and inadequate use of technological tools (robotics, AI, etc.) to date. While technology investments have stepped up of late, it typically takes a few years to feel the effect of these investments. So, basically, companies have to do all that they can to get leaner and meaner in their operating structures. That's where the AbbVie-Allergan merger makes so much sense - the companies expect the acquisition to be immediately accretive and to facilitate combined savings of $2 billion a year. Since R&D investments yield a very low rate of return, deploying those resources instead to acquire a company that will generate revenue right from the start seems like a fairly good deal. Particularly so because Allergan's main product is yet to see significant competition (the deal makes sense for Allergan because it adds to its R&D and marketing resources). Humira generated $20 billion in sales last year - around 60% of AbbVie's revenue. Therefore, the company needed to find something that could take it's place when the patent runs out in mid-2023. Already, it is seeing double-digit declines in Europe where generic medicines are available - the ability to add a relatively new patent-proof product like Botox to its product line sounds great.

So, basically, companies have to do all that they can to get leaner and meaner in their operating structures. That's where the AbbVie-Allergan merger makes so much sense - the companies expect the acquisition to be immediately accretive and to facilitate combined savings of $2 billion a year. Since R&D investments yield a very low rate of return, deploying those resources instead to acquire a company that will generate revenue right from the start seems like a fairly good deal. Particularly so because Allergan's main product is yet to see significant competition (the deal makes sense for Allergan because it adds to its R&D and marketing resources). Humira generated $20 billion in sales last year - around 60% of AbbVie's revenue. Therefore, the company needed to find something that could take it's place when the patent runs out in mid-2023. Already, it is seeing double-digit declines in Europe where generic medicines are available - the ability to add a relatively new patent-proof product like Botox to its product line sounds great. This is a far-from done deal because the companies will need necessary approvals although the lack of overlapping products likely means that there won't be anti-competitive concerns. The delay could come from a different quarter - Ireland based Allergan has been trying to sell itself since 2016 but it's $152 billion merger agreement with Pfizer fell through because that acquisition was designed to lower taxes and the government didn't take a charitable view of the situation. On Monday, Bristol-Myers hinted at a roadblock in its deal with Celgene - the company will now have to sell its multi-billion dollar anti-inflammatory drug Otezla before the deal can go through - the FTC (Federal Trade Commission) appears to be slowing things down. There's also consideration that the company may have overpaid for Botox which is the main reason that it's stock slumped to record lows - especially, because there's a slight concern that Evolus' lower-priced Jeuveau which the FDA approved in February could increase competition - marketing and reach will be factors at play.

This is a far-from done deal because the companies will need necessary approvals although the lack of overlapping products likely means that there won't be anti-competitive concerns. The delay could come from a different quarter - Ireland based Allergan has been trying to sell itself since 2016 but it's $152 billion merger agreement with Pfizer fell through because that acquisition was designed to lower taxes and the government didn't take a charitable view of the situation. On Monday, Bristol-Myers hinted at a roadblock in its deal with Celgene - the company will now have to sell its multi-billion dollar anti-inflammatory drug Otezla before the deal can go through - the FTC (Federal Trade Commission) appears to be slowing things down. There's also consideration that the company may have overpaid for Botox which is the main reason that it's stock slumped to record lows - especially, because there's a slight concern that Evolus' lower-priced Jeuveau which the FDA approved in February could increase competition - marketing and reach will be factors at play.

This is indeed a transformational transaction for both companies and achieves a unique strategic objective - to diversify AbbVie's business while sustaining their focus on innovative science and the advancement of their industry-leading pipeline into the future. It's very unlikely that we'll see a Botox biosimilar for a long long time - so, it seems like a great deal for both companies!

Comments

Post a Comment