You should literally be hiding under a rock if you haven't heard about the rise of cryptocurrency in the past couple of years. Everywhere you went, it was the talk of the town - whether you invested in it's growth or not. Wall Street was backing investments heavily into this new venture by Satoshi Nakamoto (we still don't know who this is) . For those of you who don't completely understand what Bitcoin attempts to do - think of it as you sending messages to your friends over Whatsapp over a protected, encrypted network, except that you're now exchanging currency but without any real company like "Whatsapp" - meaning, it is an open source P2P network that eliminates intermediaries like Foreign Exchanges and Banks using a smart contract. The supply for Bitcoin is currently estimated to be ₿21,000,000 and that speaks a lot - is there demand in the market now though?

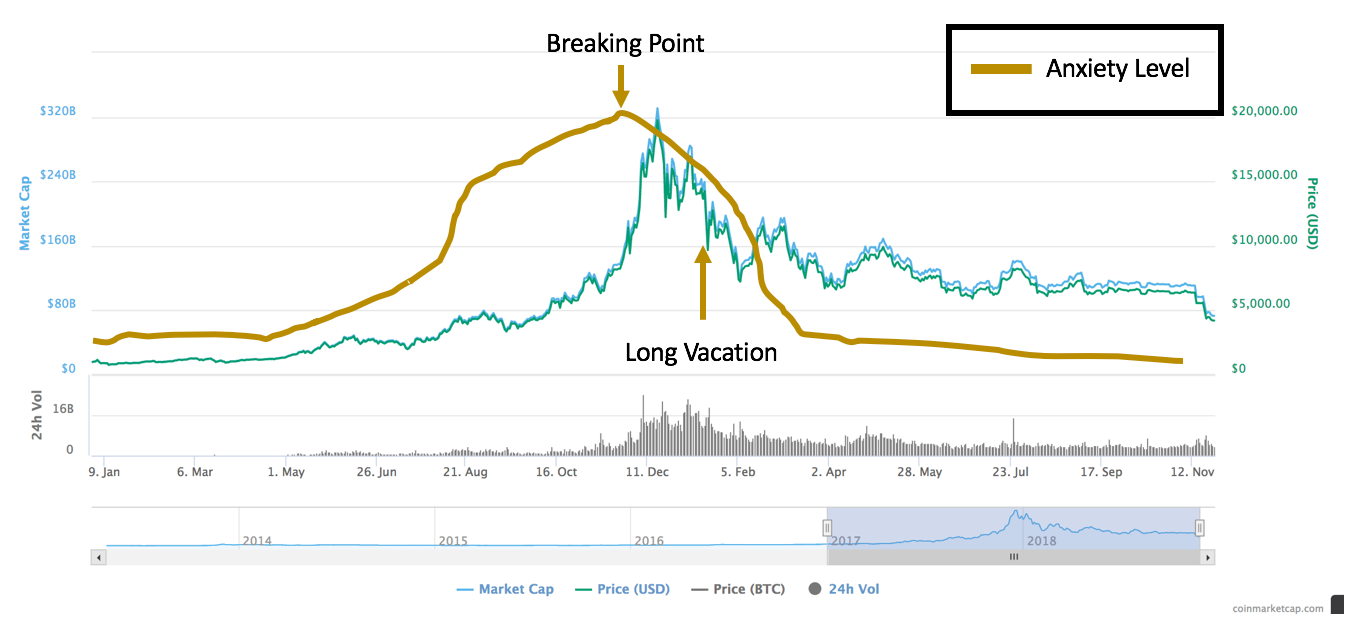

Some of you already know this - Bitcoin reached insurmountable levels in 2017 by hitting levels of ~USD20,000 on the market - an almost 2000% jump from what it was in 2016 when it was trading at USD985. The first real impact for this rise came from the People's Bank of China - the country's central bank - that looked to tighten it's oversight of China's then-dominant bitcoin exchange - it lead to a drop in trading volume as a result of new trading fees by the "Big Three" exchanges (Huobi, BTCC and OKCoin) that later stopped withdrawals due to new edicts from the PBoC. You may have heard of the Winklevoss twins (who claimed to be co-founders of Facebook) making the news at that time - and it was because they first filed to launch a bitcoin exchange-traded fund back in 2013 that eventually led to eventual rejection from the SEC (US' Securities and Exchange Commission) - the whole world was still not ready for BitCoin yet. While the SEC have since moved to review that decision - markets reacted poorly (dropped ~30%), ultimately recovering bitcoin to ~USD1000 levels. The summer of 2017 was the summer of the Bull Market - from May to September 2017 - and it resulted in a new all-time high for Bitcoin - despite the reluctance expressed by the SEC at the time, a number of firms filed to create bitcoin ETFs that tied their funds to cryptocurrency futures. There was significant activity around the initial coin offerings and they were also accompanied by intra-day turbulences with instances of a drop of ~$300 within an hour. The most major development in the summer of 2017 was the entry of major Wall St analysts like Goldman Sachs to the Bitcoin watching game. Despite the pending closure of China's Big Three exchanges and the global crackdown on unregulated ICOs taking shape, the price of bitcoin was largely buoyed by a bullish sentiment from investors when it reached an all-time high of USD19783 on Dec 17, 2017.

Some of you already know this - Bitcoin reached insurmountable levels in 2017 by hitting levels of ~USD20,000 on the market - an almost 2000% jump from what it was in 2016 when it was trading at USD985. The first real impact for this rise came from the People's Bank of China - the country's central bank - that looked to tighten it's oversight of China's then-dominant bitcoin exchange - it lead to a drop in trading volume as a result of new trading fees by the "Big Three" exchanges (Huobi, BTCC and OKCoin) that later stopped withdrawals due to new edicts from the PBoC. You may have heard of the Winklevoss twins (who claimed to be co-founders of Facebook) making the news at that time - and it was because they first filed to launch a bitcoin exchange-traded fund back in 2013 that eventually led to eventual rejection from the SEC (US' Securities and Exchange Commission) - the whole world was still not ready for BitCoin yet. While the SEC have since moved to review that decision - markets reacted poorly (dropped ~30%), ultimately recovering bitcoin to ~USD1000 levels. The summer of 2017 was the summer of the Bull Market - from May to September 2017 - and it resulted in a new all-time high for Bitcoin - despite the reluctance expressed by the SEC at the time, a number of firms filed to create bitcoin ETFs that tied their funds to cryptocurrency futures. There was significant activity around the initial coin offerings and they were also accompanied by intra-day turbulences with instances of a drop of ~$300 within an hour. The most major development in the summer of 2017 was the entry of major Wall St analysts like Goldman Sachs to the Bitcoin watching game. Despite the pending closure of China's Big Three exchanges and the global crackdown on unregulated ICOs taking shape, the price of bitcoin was largely buoyed by a bullish sentiment from investors when it reached an all-time high of USD19783 on Dec 17, 2017.

In the days that followed, there was a severe market correction to the price of Bitcoin that resulted in a 30% drop in it's value - shaving off billions of dollars of the total cryptocurrency market cap - this was one of the biggest market corrections seen to date. The prices recovered for a while, but were again in free fall and no one was sure where the bottom would lie and how far low it could really go to. The SEC's announced that two ICOs broke the law by selling unlicensed securities and had to pay the fines and restitution as a result - it was only the beginning - these two companies spent most of 2017 poking the SEC bear, and the bear woke up and meted out punishment to the world. Anyone who paid close attention to the regulatory space knew that this was coming. Another explanation for the fall was credited to the Cash Fork - where Bitcoin Cash forked from Bitcoin blockchain to form two separate entities (BCH ABC and BCH SV) - this created renewed centralization concerns over Bitcoin Cash - stating that it wasn't really a decentralized market anymore. The third arena that triggered it's fall was that the investors were spooked by the bad news from chip-makers NVDA (Nvidia) and AMD (Advanced Micro Devices) that reported steep declines for cryptocurrency equipment. The sales declines suggested that interests in the crypto world started to wane and it also raised a chicken-and-egg question : Is the chip-makers' misery a cause for the collapse, or just a symptom of the crash? There is existential explanation for the collapse: the whole thing was a bust - some investors pointed out that crypto used up $30 billion in ICO money in 2 years without really delivering a userbase beyod crypto speculators.

So what makes me blog about this now again? Well, with all the craziness that we've already seen, Bitcoin is making a move in the right direction yet again. The currency has risen by over 100% against the dollar since the start of the year and over 50% in the last month and is now trading at a 10-month high. This rise has coincided with the US President Donald Trump's policy to add 25% tariffs on $200 billion worth of Chinese imports and China retaliating in kind - the tit for tat trade war sent stocks tanking to new lows. Some market commentators think bitcoin's bull run has been fueled by investors dumping stocks and buying bitcoin as the trade-war heats up.

Some others say that Chinese investors are piling into Bitcoin to protect their wealth - reasoning that bitcoin will likely hold it's value more than Yuan over the next few months. The Chinese currency fell to it's lowest level against the Dollar since December until recently. China banned bitcoin in February 2018 but investors are reportedly still able to buy Bitcoin from over-the-counter dealers rather than online marketplaces - since it is still banned, this practice takes place in the shadows and is hard to tell how significant it's impact is.

Bitcoin's rally also coincides with Consensus 2019 in NYC - the industry's biggest annual conference where around 5000 people descended on the Manhattan Midtown Hilton Hotel to talk about bitcoin and crypto. There were a few good announcements that probably led to bitcoin pushing the price higher - Bakkt announced a plan for Bitcoin Futures; Microsoft announced that they were bulding a new identity verification tool using Bitcoin; Facebook co-founders, the Winklevoss Twins launched a new product that allows people to spend bitcoin at places like Whole Foods and Walmart. Some financial institutions have also started embracing cryptocurrency now - these follow reports that Fidelity Investments is planning to launch crypto-trading for institutional clients within the next few weeks.

Entrepreneurs and executives are quick to caution that the good times may not last - as an exchange, it seems prudent to emphasize that the prices are volatile and could be a short-term price movement yet again that may or may not evolve into something bigger. Everyone gets happy and excited about it going up and up but we could come here tomorrow and it could be again back, trading in the $3500 range yet again. So, it's your take - do you want to take a risk and triple down?

Comments

Post a Comment